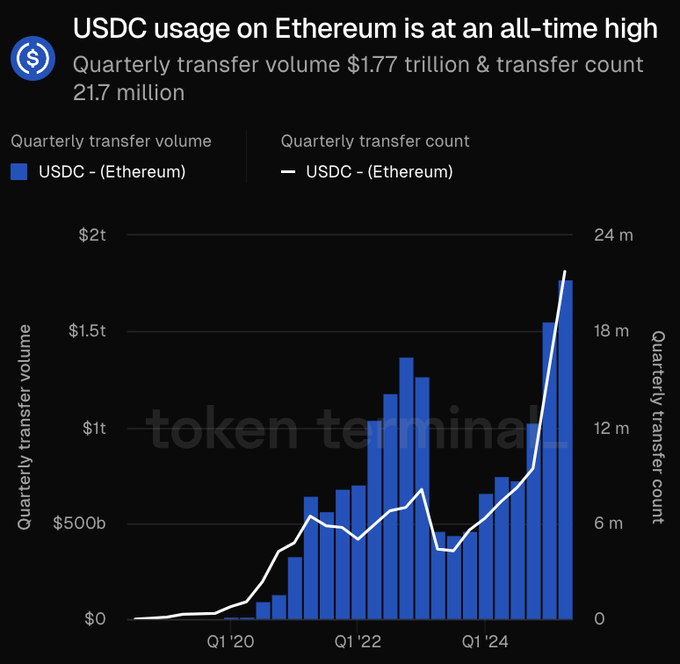

USDC transfers on the Ethereum network surged to unprecedented levels in early July 2025, culminating in a record quarterly transfer volume of approximately $1.77 trillion. This remarkable growth highlights USDC’s expanding role as a dominant stablecoin within the Ethereum ecosystem, driven by increasing adoption from both retail users and institutional players.

The outstanding supply of USDC on Ethereum has reached around $40 billion, the highest ever recorded on the network. This surge in supply and transfer activity reflects growing trust in Ethereum as the primary blockchain for stablecoin transactions and financial settlements. Monthly transfer volumes have consistently climbed, with figures surpassing previous peaks from 2022 and 2023, while the number of transfers has also reached new highs, exceeding 7 million per month. Such activity signals a robust increase in network engagement and liquidity, further cementing Ethereum’s position as the leading platform for stablecoin use.

USDC’s impressive transfer volume is underpinned by its widespread use in decentralized finance (DeFi), cross-border payments, and trading. Its stable value and regulatory compliance have made it a preferred choice for many DeFi protocols, exchanges, and payment platforms. The average transfer size of USDC on Ethereum is about $97,900, indicating a balanced mix of retail and institutional transactions. This contrasts with other stablecoins like DAI and FDUSD, which tend to have larger average transfer amounts, reflecting more specialized or institutional usage.

Despite Ethereum’s price experiencing some short-term fluctuations, the surge in USDC activity suggests strong fundamentals for the network’s broader financial ecosystem. The growing volume of USDC transfers correlates with increased capital inflows and expanding use cases, such as payments and liquidity provisioning, which contribute to Ethereum’s evolving role as a global settlement layer.

In comparison to other stablecoins, USDC maintains its leadership position, with transfer volumes far exceeding those of competitors like USDT and DAI on Ethereum. While USDT remains significant, regulatory pressures have somewhat tempered its growth, whereas USDC benefits from Circle’s proactive regulatory alignment and integration with traditional financial infrastructure, including partnerships with Visa and Mastercard.